Sophisticated Investment Strategies

Use of Options to Hedge Volatility

No doubt you’ve either read an article about stock market volatility or experienced volatility directly in your investment portfolio. Volatility ebbs and flows over time and is usually associated with periods of uncertainty or instability.

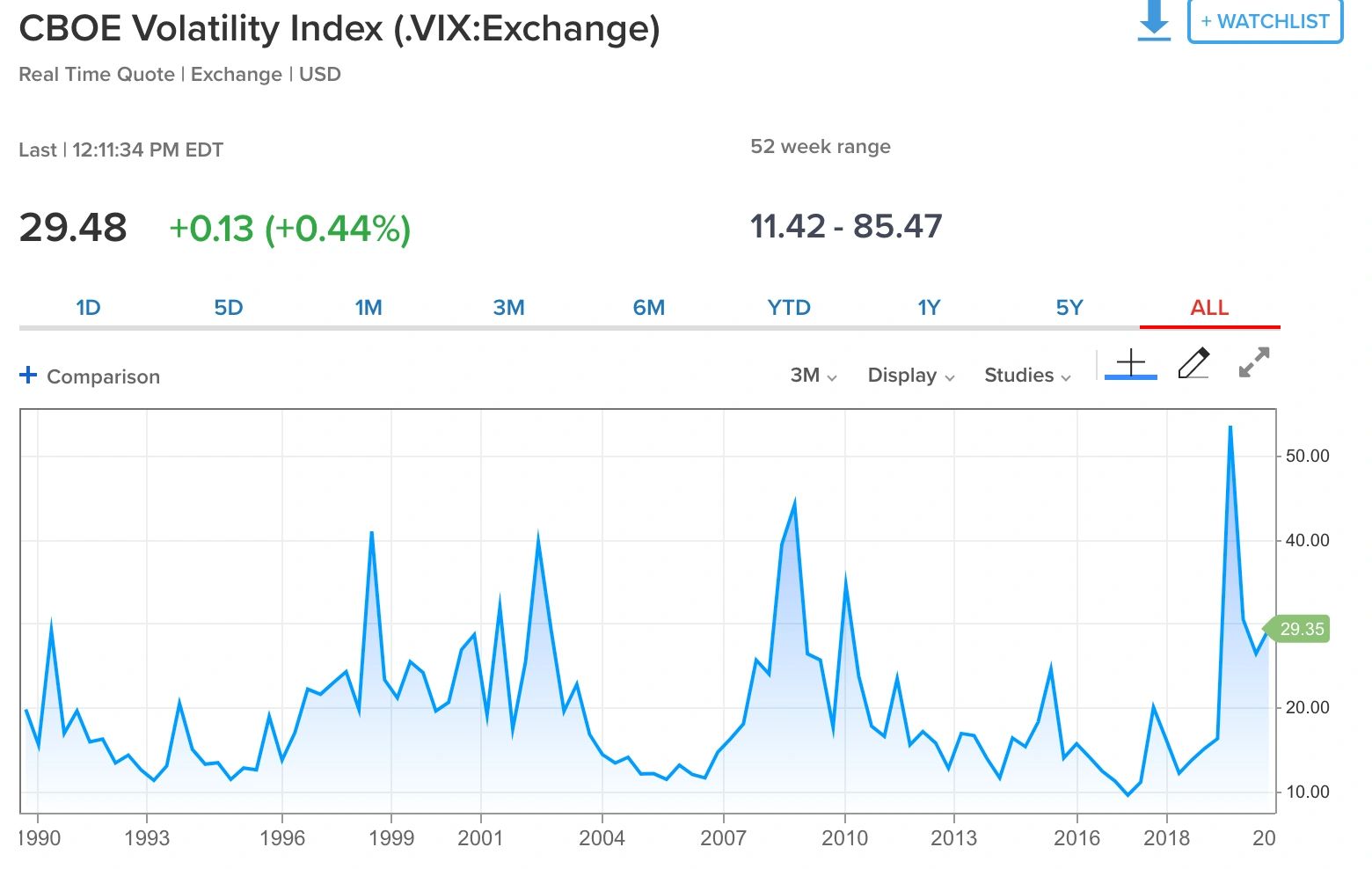

The graphic above is a CNBC chart of the “VIX” (on 10/21/20), a stock market volatility indicator used on Wall Street, with average quarterly data going back for the last 30 years. We see the big spike back in March due to the pandemic, but we also see historical spikes during recessions and other times of geo-political instability. This is normal. This is how stock markets operate. We might see more volatility with the upcoming election and we will no doubt see volatility in the future.

So, what can you do about it?

For many people, working with a fiduciary standard financial planner or investment manager is a great first step. Together, you can review your portfolio and ensure that you have an asset allocation aligned to your risk tolerance, a disciplined strategy for dollar cost averaging and rebalancing your portfolio as well as ensuring you’ve got a properly diversified portfolio with appropriate tilts. Long term planning, looking for assets that aren’t correlated and not checking your account every day are other strategies that help you get over the emotional and fear-based aspects of volatile markets. Those are all prudent steps to discuss with a financial planner or investment manager. But is there anything else you can do?

One approach is to actively manage your portfolio and make tilts towards stocks or sectors that may be better positioned than others to get through whatever volatility we are experiencing. We’ve written about the “New Normal” and have been looking for companies with innovative approaches, flexible strategies and direct to consumer capabilities. We believe these companies will fare better in the long run.

Prudent planning and diversification can help smooth ups and downs, but the markets are still volatile and big portfolio swings can be unnerving and may lead us to realize that we are potentially taking on outsized risk with our portfolios. One way to help manage this risk is through the use of exchange traded options.

There are many different options strategies that one can use to manage risk and it is also very important to ensure that you fully understand how options work and how to trade them before doing so on your own. We have been using options strategies for clients for many years and one approach we are using now is covered call writing which is a great strategy for generating current income and providing some downside protection. Here’s how the strategy works:

Say we own 100 shares of High Flying Stock Corporation HFSC (a fictional corporation, but using real data). Say the price of the stock is $490 and is up 80% YTD. We can sell someone else the “option”, or “right” to buy our shares for $515 at any point in the next 3 months for $2,800. They pay us the $2,800 premium up front ($28 X 100 shares) and we keep it no matter what happens next.

So what can happen next?

Let’s say the stock stalls and remains at $490. We keep the $2,800 plus our shares. Although the price of the stock didn’t appreciate, we realized a return of almost 23% annualized (2,800/ 49,000X 4). We’ve given ourselves a nice income stream on a stock that didn’t move in price.

Alternatively, let’s say the stock drops to $460. An uncovered stockholder would lose $30 per share, but since we’re “covered” and got $28 per share in premium up front, we’ve only lost $2 per share. We’ve given ourselves some downside protection.

Alternatively, let’s say the stock stays hot and goes up $540. Well, we’re still ahead. Our shares are going to be “called away”, but we get the agreed upon price of $515, plus our $28 per share up front, so we get $543 per share. A nice profit of 43% annualized. ($28 + $25 in appreciation = $53 / $49,000 X 4). We’re disciplined in our selling.

Where we give up return is on the extreme upside. Say the stock goes to $600. Well, now we’re a bit sad that we have to sell it for $515. We’ve given up that high upside potential for the protection on the downside and the income. There’s always a trade-off with investing. Our objective is to help you understand the risks of various investments and help you achieve your investing goals by both taking and hedging risks.

This is just one option strategy you can use and isn’t necessarily a strategy you want to use on a position you really want to hold for the long term or believe has high short-term upside. If those are your beliefs, well there are other strategies to employ. If you’d like to discuss options strategies in general or in relation to your portfolio specifically, please contact us to discuss.

DISCLOSURES

The views expressed represent the opinions of Cottage Street Advisors and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person.

Additional information, including management fees and expenses, is provided on Cottage Street Advisors’ Form ADV Part 2, which is available upon request.

Copyright © 2020, Cottage Street Advisors, LLC

Copyright © 2025 Cottage Street Advisors, LLC - All Rights Reserved.

Site content may not be used without the express written consent of Cottage Street Advisors, LLC.